Balance Your Best Interests,

Get a Personal Loan In Delhi NCR For All Your Financial Needs

Personal loan in Delhi NCR : Loan11 Possible is a trusted company for providing instant personal loan in Delhi NCR, committed to making your personal loan approval journey smooth. Get financial assistance for emergency expenses, debt consolidation, large purchases and much more.

So whether it’s a loan for wedding, loan for vacation, or New Car loan a planned expense or an unplanned purchase, we got you covered. Get in touch with us to know more about our services for personal loans in Delhi. We ensure personalised help and quick updates on your loan approval.

When it comes to personal loans, borrowers often seek options that align with their specific needs and circumstances. There are money type of personal loans requirement like:

“Low interest personal loan for home renovation”

“Personal loan for debt consolidation with bad credit”

“Quick approval personal loan in delhi ncr for medical emergencies”

“Unsecured personal loan for self-employed individuals”

“Personal loan in delhi ncr for students with no credit history”

But our prevalent type is “quick loan” which provides rapid access to funds for urgent expenses, offering convenience and flexibility. Another popular choice is the “secure loan,” where borrowers offer collateral, such as property or assets, to secure favorable terms and lower interest rates. For those prioritizing affordability, “low-interest personal loans” stand out, offering competitive rates to minimize long-term financial burdens. With the increasing digitization of financial services, “personal loans online” have gained traction, allowing borrowers to conveniently apply, manage, and receive funds entirely through digital platforms, streamlining the borrowing process and enhancing accessibility. Whether seeking speed, security, affordability, or convenience, the diverse range of personal loan in delhi ncr options ensures borrowers can find the right fit for their financial needs.

Get a Higher Financial Attitude, the Right Way

Documents Required For Salaried Individuals

Documents Required For Self-Employed Individuals

Personal Loan For Emergency

Apply for an emergency loan online and get quick funds. Our instant emergency loan ensures you have the money when you need it. Secure an instant personal loan today! Most trusted company for personal loan in Delhi NCR

Personal Loan For Wedding

Planning a wedding? Secure a marriage loan for all your expenses. Our wedding loans offer fast approval and flexible terms. Apply now for an instant personal loan and make your special day unforgettable. Most trusted company for personal loan in Delhi NCR

Personal Loan For Student

Invest in your education with our exclusive student loans. Streamlined student loan application process for college students. Access instant personal loan for academic pursuits today. Most trusted company for personal loan in Delhi NCR

Personal Loan For Doctor

Achieve your professional goals with our tailored loan for doctors. Quick approval for instant personal loan. Elevate your practice with a personal loan for Doctor. Most trusted company for personal loan in Delhi NCR

Personal Loan For Medical Expenses

Get financial support for medical expenses with our specialized loan for medical treatment. Apply now for a medical loan with quick approval and an instant personal loan tailored for your healthcare needs. Most trusted company for personal loan in Delhi NCR

Personal Loan For Home Renovation

Need funds for home renovation or house repair? Get a personal loan for house construction. Fulfill your dream with flexible terms and quick approval. Apply now. Most trusted company for personal loan in Delhi NCR

Getting a personal loan in Delhi NCR with a low CIBIL score can be challenging, but not impossible. Various financial institutions, NBFC now offer loans for low cibil scores, understanding that past financial mistakes shouldn’t always limit present opportunities. These loans from private loan provider in Delhi frequently have relatively higher interest rates, but if you do complete research, you will find Loan11 Possible is the most trusted and affordable loan provider company for personal loan low cibil score. Instant personal loan solutions that are suitable for your needs. Moreover, Loan11 Possible provide instant personal loans, with personal loan eligibility ensuring quick access to funds when you need them the most. Whether you’re looking for debt consolidation or emergency expenses, personal loans in Delhi NCR cater to diverse financial needs even with a less-than-perfect credit score.

Personal Loan Interest Rate

Personal Loan In Delhi NCR --------

Turning Money Problems into Solutions

Are you looking for personal loans in Delhi NCR that meet your pressing needs and demands? Or are you falling in the danger of a debt trap and looking for a solution to climb out of it. Loan11 Possible makes it possible for you to get an instant personal loan to help you with your debts and personal needs. Get quick approval on personal loans with minimal documentation and no heavy paperwork. We are your trusted financial friend for all your financial needs. With us, you experience easy and hassle-free disbursal of loans.

Financing Partner for Personal Loan In Delhi NCR

Why Choose

Loan11 Possible For Personal Loans In Delhi NCR

- We proffer our services as an online platform to make it conveninent for you to get cash loan. Get easily accessible personal loan in delhi ncr at lowest interest rate.

- You only need few document to get personal loan approved. Photo, ADHAR Card and PAN Card, Last three month salary slip and last six months salary transaction to get your loan from us.

- Loans get approved in 30 minutes. So if you are wondering how to get instant personal loan, wonder no more. Do connect with us to get your loan approval today

- We don’t ask for collateral on personal loan in delhidau

Frequently Answered Questions

- Determine Your Requirement: Identify the purpose of the loan and the amount you need.

- Check Loan Eligibility: Verify if you meet the eligibility criteria set by the lender.

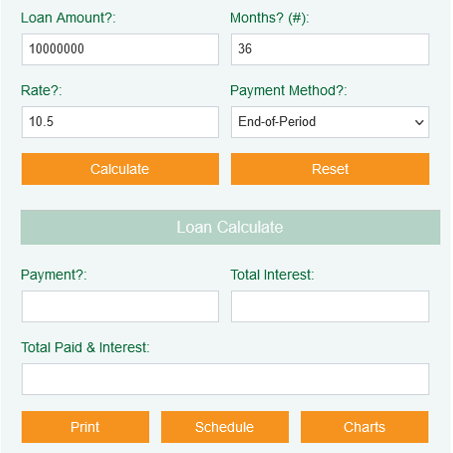

- Calculate Monthly Instalments: Use a loan calculator to estimate your monthly payments.

- Approach the LENDER/Bank: Contact the bank or financial institution to express your interest in the loan.

- Submit Documents: Provide the necessary documents such as proof of identity, address, and income.

Yes, at Loan11 Possible, we accept all CIBIL Cases with positive mitigation of customers. If you have a CIBIL issue, we will help you in getting your personal loan processed.

To apply for a Personal Loan in Delhi NCR is straightforward with Loan11 Possible private finance in Delhi, you must submit essential documentation such as your AADHAR or PAN card to verify your identity and residence in Delhi. These documents are crucial for lenders to assess your eligibility for an instant personal loan in Delhi. its fast and quick loan.

Document required for loan approval personal loan in delhi NCR.

Pan Card, Latest 3 month salary slip statement, Aadhar card, Form 16, Photo, Salary transaction 6 month banking

Personal Loans get approved in 30 minutes. So if you are wondering how to get instant personal loan, wonder no more. Do connect with us to get your loan approval today

Across various banks, the maximum loan amount approval varies, typically ranging from 80% to 90%. Some banks even extend loans covering the entire ex-showroom price of the vehicle. It’s advisable to explore new car loan rates, auto loan interest rates, including those offered by specific institutions like HDFC new car loan interest rate and SBI new car loan interest rate, to make an informed decision.

Its totally depends on the lender and their specific eligibility criteria to qualify for a personal loan in DELHI from most lenders, you typically need to earn at least Rs. 15,000 per month. If your monthly income is lower than this amount, you might not meet the eligibility criteria set by these lenders to get a personal loan. But still you can contact to the lender. Apply Now

Yes, a pensioner can apply for a personal loan in Delhi NCR . Many banks and financial institutions offer personal loans specifically tailored for pensioners. APPLY NOW

Students may qualify for personal loans, though approval typically hinges on factors such as their credit history, income (if any), and the presence of a co-signer with strong credit.

Personal loans that can be used to cover the costs of getting married. You can apply for a Marriage Loan starting at ₹50,000 and going up to ₹50 lakh, with interest rates as low as 10.80%* annually.

Lenders rarely approve two personal loans in delhi ncr at the same time. It is generally not advised for borrowers to apply for multiple unsecured loans at the same time, even though you might be eligible for a second personal loan from a separate lender.

Borrowers can pay off their loan in full or partially without any penalties six months after receiving the loan. However, if they pay more than 25% of the remaining loan amount at once, a 2.5% fee plus GST will apply. Borrowers can only make one partial payment like this each year.

Personal Loan In Delhi NCR >>

Document requirement details

- Pan card

- Latest 3 month salary slip statement

- Aadhar card

- Form 16

- Photo

- Salary transaction 6 month banking