Get Freedom From Financial Burden

Secured Loan Opportunities Offered Via Loan Against Property

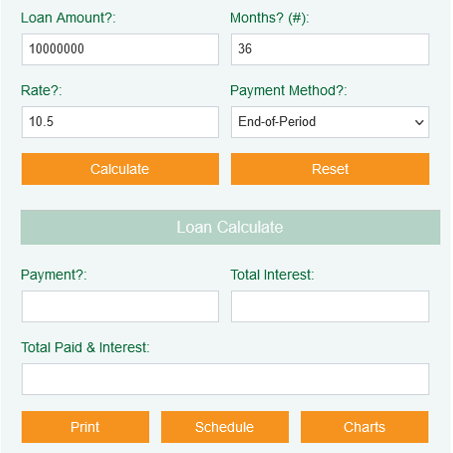

Loan11 Possible is your secure loan yielding platform, where easy access to business loans, home loans or any personal loan is made possible by offering Loan against property. Anyhow if you transpire with a sudden loan requirement of a handsome amount, then your loan problem gets easy with Loan11 Possible, where you can get your desired credit against the property at low-interest rates. We screen your property marketing value and all the documents to provide you with the loan by keeping the bank guidelines on priority. The loan approval is guaranteed swiftly and the complete amount will be disbursed in your account after the screening of your documents.

Loan11 Possible presents you the jaw biting loan approval via loan against property by the guidance of fiscal experts and skilled professionals. The percentage of interest is decided on the documents that are scrutinized and the bank guidelines that are mandatory for your loan procedure and approval.

Benefits Witnessed on

Loan Approval from Loan11 Possible

Your desire for a loan and the problems that are faced during the loan approval are ditched by Loan11 Possible and we make it as easy as possible for you to get your loan sanctioned quickly and reliably. We offer customized property loans and loans for salaried and self-employed individuals, by following some simple steps of documentation done with verification of ADHAAR and Pan cards. Introducing the loan against property to you by offering you low EMI on loans is the uniqueness of our services.

Loan11 Possible justify loans, if any old existing loan is in progress and there are some issues faced with credit cards payments, then we offer a helping hand by justifying your documents and written brief stating, that you are facing a genuine issue. At that time, Loan11 Possible plays the role of justifier and clears all your loan hassles with positive mitigation of

customers.

Why Choose Loan11 Possible

As Your Trust Partner For LOAN Approvals

Minimal Documents required

Competitive interest rates offered.

Hassle-free and quick loan processing

Simplified disbursement

Minimum to maximum loan amount sanction.

Why Choose Loan11 Possible for

LOAN AGAINST PROPERTY

Facing an issue in business, personal or home loans? You don’t need to burden yourself with that, all you need is just make a call to Loan11 Possible and branch your loan problems with us, to find a sustainable and quick loan solution via Loan Against Property. If you require a handsome ransom, then we can provide you with that amount by giving you a loan against your property, which means you can submit your Government Authorized property documents to us and we will offer you the desired loan amount at competitive interest rates that are mentioned according to the guidelines of the bank.

Frequently Answered Questions

Yes, at Loan11 Possible, we accept all CIBIL Cases with positive mitigation of customers. If you have a CIBIL issue, we will help you in getting your loan processed.

Loan Against Property

Document requirement details

Self Employed

- Pan card

- Latest 6 months Bank statment

- Aadhar card

- RC/Insurance (which car you purchase) Salaried Person

- Pan card

- Photo

- Last 2 years ITR with competition

- Recent E bill (Owned house)

- GST

Salaried Person

- Pan card

- Latest 6 months Bank statment

- Aadhar card

- RC/Insurance (which car you purchase)

- Photo

- Recent E bill (Owned house)

- Photo

- Form 16 part A or B

- Recent 3 months salary slip